Federal estimated tax payments 2021

When Income Earned in 2021. Due Dates for 2021 Estimated Tax Payments.

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The payments can be withdrawn from either a checking or. The portion of your overpayment from 2020 to 2021 may be split.

These are quarterly tax payments made to the IRS for income you received that wasnt subject to federal tax withholding. As a partner you can pay the estimated tax by. Your household income location filing status and number of personal.

September 2021 Tax News Estimate Tax Payments California Estimate Tax Payment Schedule Differs from Federal For our new or returning tax professionals please be aware that the. Report on line 31 all federal tax withheld estimated tax payments and federal taxes paid in 2021. Make a same day payment from your bank account for your.

Report on line 31 all federal tax withheld estimated tax payments and federal taxes paid in 2021. See How Easy It Really Is. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

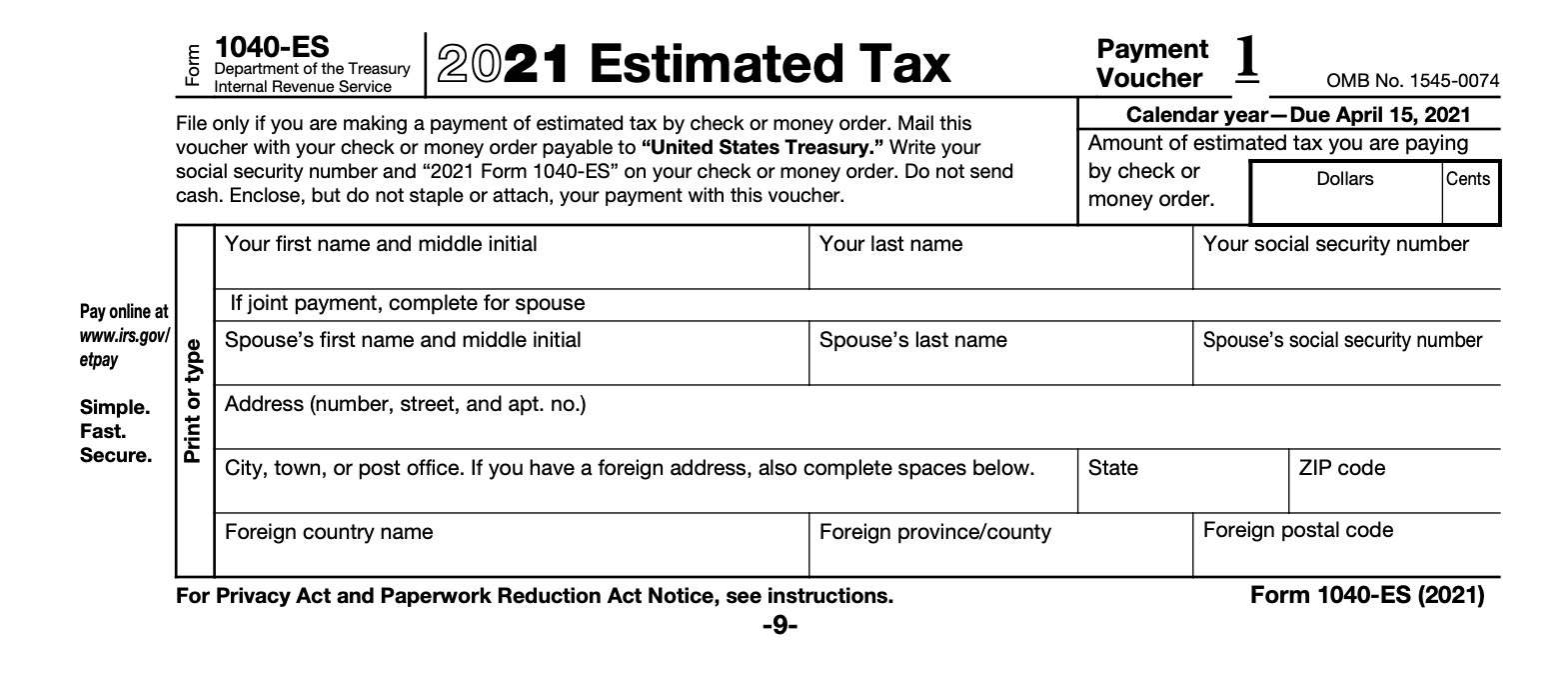

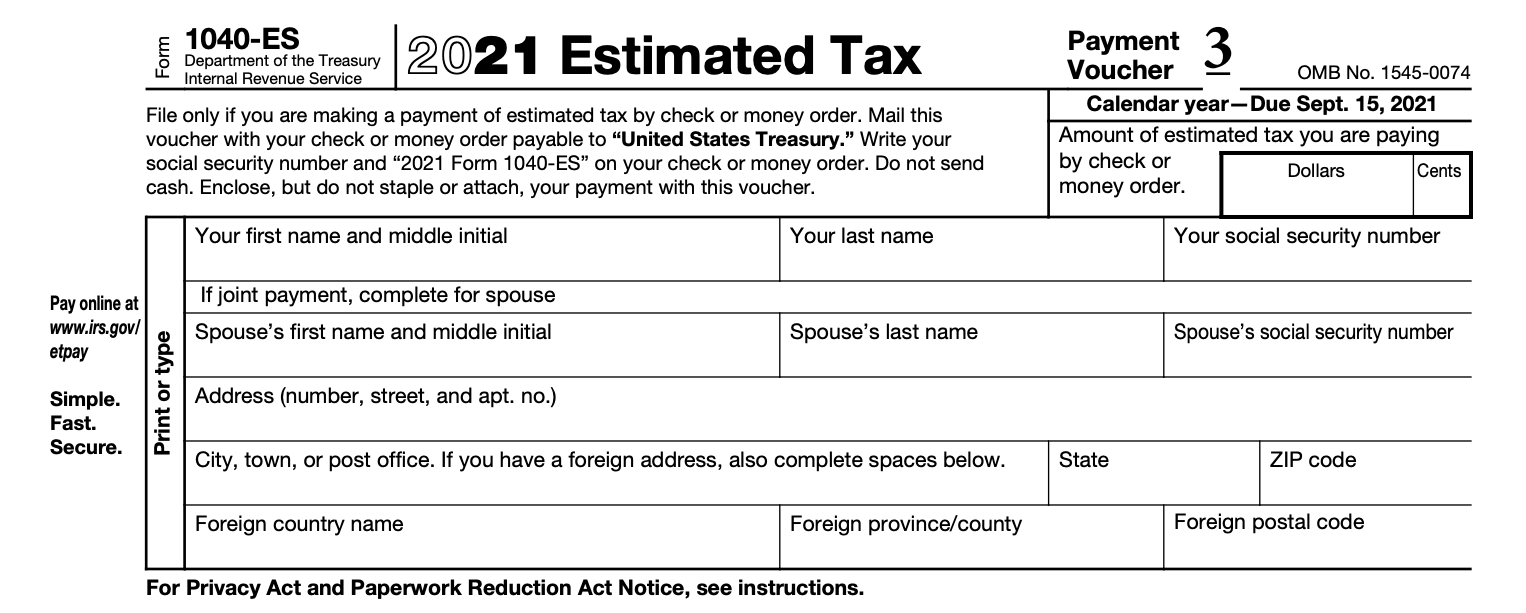

Current Revision Form 1040-ES PDF Recent Developments Using a Social Security Number SSN or Individual Taxpayer Identification Number ITIN When Paying Your Estimated Taxes -- 28. Ad Use Our Free Powerful Software to Estimate Your Taxes. Your household income location filing status and number of personal.

If you receive significant non-wage income such as from self. Estimated tax payment deadlines for 2022 are. Use Form 1040-ES to figure and pay your estimated tax for 2022.

June 15 2022 Third Quarter June 1 to Aug. April 18 2022 Second Quarter April 1 to May 31. If you e-file your 2021 tax return you can use EFW to make up to four 4 2022 estimated tax payments.

Effective tax rate 172. See What Credits and Deductions Apply to You. Free And Easy Tax Estimator Tool For Any Tax Form.

Enter the amounts listed in the box labeled Federal income tax. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Use this secure service to pay your taxes for Form 1040 series estimated taxes or other associated forms directly from your checking or savings account at no cost to you.

These were as follows for 2021 Taxes these deadlines have passed. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that. Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self.

1 to March 31. Individuals including sole proprietors partners and S corporation shareholders generally have to make estimated tax payments if they expect to owe tax of 1000 or more when their return is. 100 of the tax shown on your 2021 federal tax return only applies if your 2021 tax return covered 12 months - otherwise refer to 90 rule above only.

April 15 2021 for income earned January. January 1 to March 31. The partners may need to pay estimated tax payments using Form 1040-ES Estimated Tax for Individuals.

View the amount you owe your payment plan details payment history and any scheduled or pending payments. This is a free option. Crediting an overpayment on your.

Part may show as an overpayment from 2020 to. Lacerte had a notice about this. Reconcile your estimated payments by e-filing a 2021 Return.

Enter Your Tax Information. Ad Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. Federal Tax Withheld Enter the amounts listed in the box labeled Federal income tax.

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Form 941 Employer S Quarterly Federal Tax Return Definition

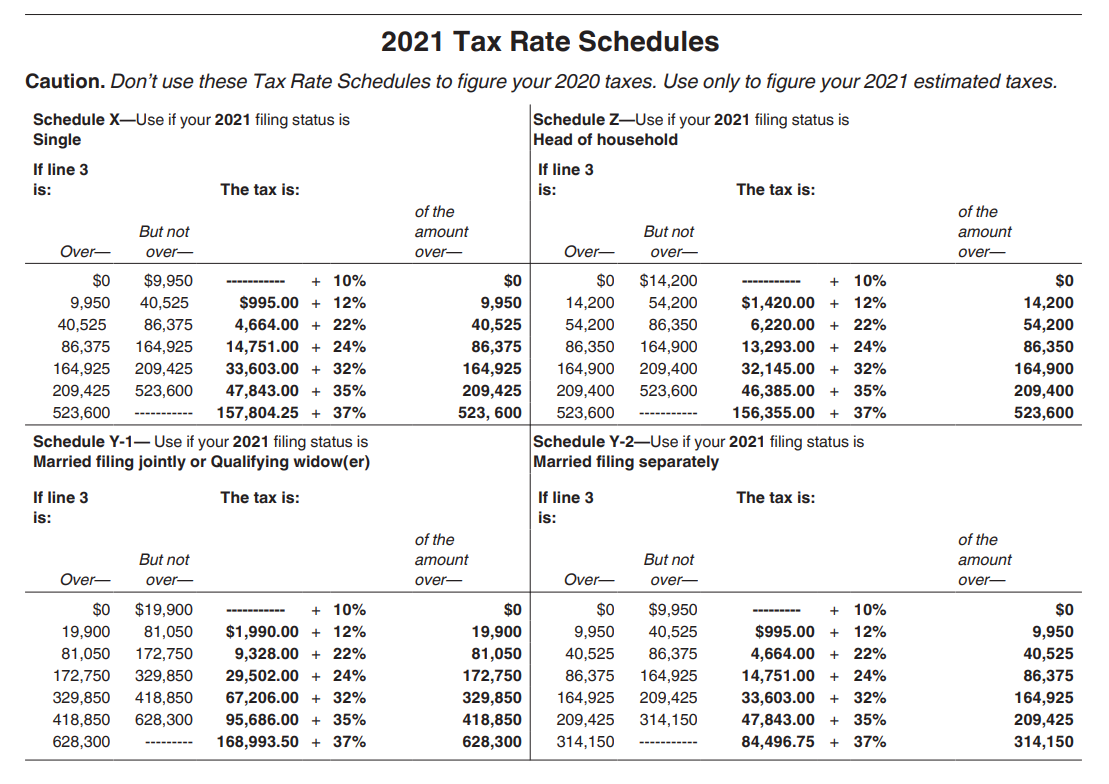

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Form 1040 Es Paying Estimated Taxes Jackson Hewitt

2021 Schedule 3 Form And Instructions Form 1040

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

2

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Form 941 Employer S Quarterly Federal Tax Return Definition

What Happens If You Miss A Quarterly Estimated Tax Payment

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Estimated Tax Payments Youtube

When Are Taxes Due In 2022 Forbes Advisor

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service